Circular No. 42/2015/TT-BTC the customs procedure applied to outgoing incoming transit means of transport đã được thay thế bởi Circular 50/2018/TT-BTC forms of documents used for customs declaration of outbound inbound và được áp dụng kể từ ngày 05/06/2018.

Nội dung toàn văn Circular No. 42/2015/TT-BTC the customs procedure applied to outgoing incoming transit means of transport

THE MINISTRY OF FINANCE | THE SOCIALIST REPUBLIC OF VIETNAM |

No. 42/2015/TT-BTC | Hanoi, March 27, 2015 |

CIRCULAR

STIPULATING THE CUSTOMS PROCEDURE APPLIED TO OUTGOING, INCOMING AND TRANSIT MEANS OF TRANSPORT

Pursuant to the Law on Customs No. 54/2014/QH13 dated June 23, 2014;

Pursuant to the Government’s Decree No. 27/2007/NĐ-CP dated February 23, 2007 on electronic transactions in the scope of financial operations;

Pursuant to the Government’s Decree No. 83/2007/NĐ-CP dated May 25, 2007 on management and operation of airports and airfields;

Pursuant to the Government’s Decree No. 80/2009/NĐ-CP dated October 1, 2009 on stipulating foreigner’s cars registered in overseas countries and designed with right-hand wheel when driving in Vietnam;

Pursuant to the Government’s Decree No. 27/2011/NĐ-CP dated April 9, 2011 on provision, operation, processing and utilization of information about passengers before entering Vietnam by air;

Pursuant to the Government’s Decree No. 21/2012/NĐ-CP dated March 21, 2012 on management of seaports and navigable channels;

Pursuant to the Government’s Decree No. 152/2013/NĐ-CP dated November 4, 2013 on management of motorized means of transport carried into Vietnam by foreigners to serve the tourism purpose;

Pursuant to the Government's Decree No. 215/2013/NĐ-CP dated December 23, 2013 on defining the functions, tasks, powers and organizational structure of the Ministry of Finance;

Pursuant to the Government’s Decree No. 34/2014/NĐ-CP dated April 29, 2014 on regulations on the land border of the Socialist Republic of Vietnam;

Pursuant to the Government’s Decree No. 112/2014/NĐ-CP dated November 21, 2014 on stipulating management of the land border gate;;

Pursuant to the Government’s Decree No.08/2015/NĐ-CP dated January 21, 2015 on specifying and implementing the Law on Customs on customs procedure, customs inspection, supervision and control;

At the request of the Director of the General Department of Customs,

The Minister of Finance hereby promulgates the Circular on stipulating the customs procedure applied to outgoing, incoming and transit means of transport.

Part I

GENERAL INSTRUCTIONS

Article 1. Scope of application

This Circular stipulates the customs procedure applied to outgoing, incoming and transit means of transport through land, inland waterway and rail bordergates, international seaports and airports.

Article 2. Applicable entities

1. Customs authorities and officers.

2. Persons who carry out customs declaration for outgoing, incoming and transit means of transport.

3. Other governmental agencies that cooperate in the customs management of outgoing, incoming and transit means of transport.

Article 3. Interpretation of terms

Terms used herein shall be construed as follows:

1. The information portal of the General Department of Customs refers to the information system administrated by the General Department of Customs on a centralized and consistent basis, and used for completing the electronic customs procedure.

2. Electronic customs declaration system refers to the information system used for completing the electronic customs procedure by customs declarants.

3. Electronic customs procedures applied to incoming, outgoing or transit ships, aircraft refers to the customs procedure under which customs declaration, reception of cargo declarations and other relevant documents and decision on completion of the electronic customs procedure applied to incoming, outgoing or transit ships or aircraft shall be carried out through the information portal of the General Department of Customs.

4. Paper-based customs procedures applied to incoming, outgoing or transit ships, aircraft refers to the customs procedure under which customs declaration, reception of cargo declarations and other relevant documents and decision on completion of the electronic customs procedure applied to incoming, outgoing or transit ships or aircraft shall be carried out through paper-based customs procedures.

5. Completion of electronic customs procedures applied to incoming, outgoing or transit ships, aircraft refers to the customs authority’s authenticating completion of electronic customs procedures applied to incoming, outgoing or transit ships or aircraft through the information portal of the General Department of Customs.

6. Incoming, outgoing road vehicle management system refers to the software administrated by the General Department of Customs on a centralized or consistent basis, and used for updating information, monitoring and completing customs procedures applied to temporary import - re-export, temporary export - re-import means of transport.

Article 4. Location of customs procedures

1. As for sea transport.

a) Location of reception, registration and inspection of customs documentation:

a.1) The customs authority’s office via the information portal of the General Department of Customs;

a.2) Main office or representative office of the Maritime Administration where the customs authority in some unexpected circumstances fails to carry out the electronic customs procedure (must carry out the paper-based customs procedure);

a.3) At the anchorage upon the request of the Maritime Administration. The customs procedure shall be completed at this area if there is the reasonable doubt that quarantine-related declarations of ships or those coming from regions hit by epidemic diseases associated with human beings, animals or plants are not authentic.

b) Location where the physical state of means of transport is verified: at the bordergate where ships are moored under the directive of the Director of the Maritime Administration.

2. As for the international air transport: at the customs office located at the international airport.

3. As for the international intermodal rail transport: at the customs office located at the international intermodal rail station.

4. As for road vehicles or inland watercraft.

a) At the customs office located at the land or inland bordergate;

b) The customs inspection area shared between the customs authority of Vietnam and neighboring countries located at the land bordergate.

Article 5. Customs declarant

1. As for sea transport.

a) Master or legal representative of the carrier (ship owner or ship agent) shall assume responsibility for carrying out customs declaration and completing customs procedures;

b) In case ship owner or ship agent have not kept sufficient detailed information about the house bill of lading, such as description of commodities, consignor and consignee, the freight forwarder, who issues such bill of lading, shall be responsible for creating and uploading electronic information about this house bill of lading on the information portal of the General Department of Customs.

2. As for international air transport.

a) The chief pilot or legal representative of the carrier (airline or airline’s designator) shall assume responsibility for carrying out customs declaration and completing customs procedures;

b) As for electronic customs procedures, if the airline or airline agent have not kept sufficient detailed information about the house airway bill of lading, such as description of commodities, consignor and consignee, the freight forwarder, who issues such bill of lading, shall be responsible for creating and uploading electronic information about this house airway bill of lading on the information portal of the General Department of Customs.

3. As for international road transport: the operator or carrier's agent or fleet representative stipulated in Clause 2 Article 34 hereof.

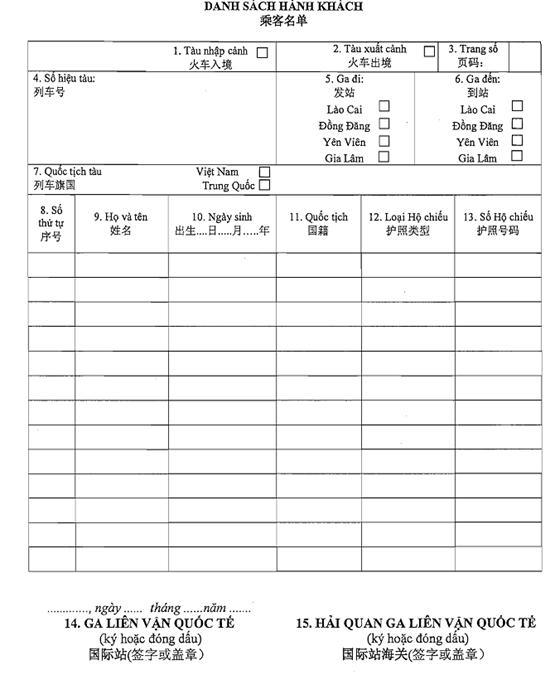

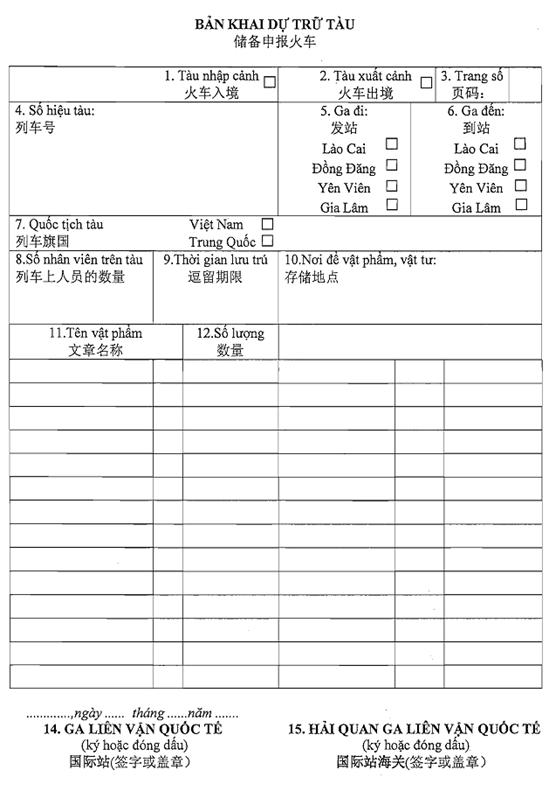

4. As for international intermodal rail transport: terminal head or train head or individuals authorized by terminal head or train head.

Article 6. Registration for participation in electronic customs procedure that applies to incoming, outgoing or transit aircraft

1. Implementing entities.

a) Airlines that have already used standardized data stored in the customs declaration software and synchronized with the standardized data approved by the General Department of Customs;

b) Airlines that electronically send their participation confirmation (by completing the form No. 1 of Appendix I enclosed herewith) to the information portal of the General Department of Customs;

c) Within 02 working days of receipt of participation confirmation from airlines, the General Department of Customs shall consider admitting or refusing these registrations (in which reasons for the refusal must be clearly stated) through the information portal of the General Department of Customs;

d) The General Department of Customs shall be responsible for granting accounts used for completing electronic customs procedures to airlines while the Customs Department of a province or city shall assume their responsibility to grant such accounts to airline’s designators and freight forwarding companies. When receiving the notification of granting accounts from the General Department of Customs or the Customs Department of a city or province, airlines, airline’s designators and freight forwarding companies, shall be responsible for changing, storing and using these accounts.

2. As for airlines that have yet to use the electronic customs procedure, their completion of paper-based customs procedures shall be governed under the provisions of Section 4, Chapter II, Part II hereof.

Article 7. Registration for participation in electronic customs procedure that applies to incoming, outgoing or transit seagoing vessels

1. Implementing entities.

a) Vietnamese seagoing vessels, or overseas ones which enter, exit or transit, except for types of vessels stipulated at Point b, Clause 1 of this Article;

b) As for other vessels stipulated in Article 50, 58 of the Decree No. 21/2012/NĐ-CP and those without call sign (IMO number), if they have to complete the customs procedure in accordance with legal regulations, they must complete it in the paper-based form under the instructions of Section 4, Chapter I, Part II hereof.

2. Steps in registration for participation in the electronic customs procedure

a) The General Department of Customs shall be responsible for granting accounts used for completing electronic customs procedures to ship owner while the Customs Department of a province or city shall assume their responsibility to grant such accounts to ship agents and freight forwarding companies. When receiving the notification of granting accounts from the General Department of Customs or the Customs Department of a city or province, ship owner, ship agent or freight forwarding companies, shall be responsible for changing, storing and using these accounts.

b) In case ship owner, ship agent or freight forwarding company has already kept accounts used for completing electronic customs procedures, they shall not be required to carry out the re-registration under the provisions of Clause 2 of this Article.

Article 8. Principles of completing electronic customs procedure that applies to incoming, outgoing or transit seagoing vessels, aircraft

1. Carrying out the customs declaration and providing information in the customs declaration must be completed before arrival and departure within the permitted period stipulated in Article 69 of the Customs Law.

2. Confirming that the customs procedure applied to incoming, outgoing or transit seagoing vessels or aircraft has been completed shall be decided before seagoing vessels or aircraft arrive or depart with reference to information provided in the customs declaration.

Article 9. Collection of fee for completing customs procedures

1. Fee-paying entities, fee level, policy on collection, handover, management and use of customs fee shall be regulated by the Ministry of Finance.

2. Fee-paying location: Customs declarants shall pay customs fee through money transfer or direct cash payment at the State Treasuries, credit institutions, or organizations authorized by competent authorities to collect customs fee, or customs offices.

3. Forms of customs fee payment

a) As for paper-based customs procedures, customs declarants shall complete the customs procedure for their means of transport by paying customs fee for each time their means of transport enters, exits or transits through customs checkpoints;

b) As for electronic customs procedures, customs declarants shall be entitled to decide on paying customs fee for completing customs procedures for their means of transport for each time their means of transport enters, exits or transits through customs checkpoints under the provisions of Point a Clause 3 of this Article, or making monthly payment of customs fee. Procedure for making monthly payment of customs fee:

b.1) Customs declarants send their request for monthly payment of customs fee to the Customs Subdepartment where they are required to complete the customs procedure for their means of transport and obtain approval from this Customs Subdepartment;

b.2) By the end of registered time period, customs declarants are required to pay customs fee for their means of transport that may additionally enters, exits or transits.

Part II

SPECIFIC INSTRUCTIONS

Chapter I

CUSTOMS PROCEDURE THAT APPLIES TO INCOMING, OUTGOING OR TRANSIT SEAGOING VESSELS

Section 1. ELECTRONIC CUSTOMS PROCEDURE THAT APPLIES TO INCOMING SEAGOING VESSELS

Article 10. Creation of electronic information to be provided for customs documentation

1. Customs declarants shall be entitled to select one of two forms of creating electronic information as follows:

a) Creating electronic information which conform to format standards approved by the General Department of Customs and then sending them to the information portal of the General Department of Customs; or

b) Directly carrying out the customs declaration at the information portal of the General Department of Customs.

2. Electronic customs documentation of an incoming seagoing vessel shall include the specific documents stipulated in the Appendix II enclosed herewith:

a) General declaration form No. 1;

b) Imported sea freight manifest form No. 2;

c) House bill of lading form No. 3;

d) Crew list form No. 4;

dd) Seagoing vessel crew’s effects declaration form No. 5;

e) Ship’s stores declaration form No. 6;

g) Passenger list form No. 7 (if available);

h) Declaration of dangerous goods, if ships are carrying dangerous goods, form No. 8.

3. Receipt of information and response to information included in electronic customs documentation.

a) Customs declarants send electronic customs documentation within the permitted period as prescribed in Clause 1 Article 66 of the Decree No. 08/2015/NĐ-CP;

b) The information portal of the General Department of Customs receives information provided by carrying out the electronic customs declaration during 24 hours a day and 07 days a week;

c) Response to information:

c.1) In case declared information conform to all regulated criteria and formats, the customs electronic data processing system shall accept such information by automatically sending the form No. 9 of Appendix II enclosed herewith;

c.2) In case declared information do not conform to all regulated criteria and formats, the customs electronic data processing system shall automatically send notification of reasons for refusal and provide guidance for customs declarants to carry out the customs redeclaration by completing the form No. 9 of Appendix II enclosed herewith.

4. Correction and addition of information provided in the electronic customs documentation of an incoming seagoing vessel.

a) Customs declarant: if there is any request that information provided in the electronic customs documentation of an incoming seagoing vessel must be corrected or supplemented, customs declarants shall carry out this correction or addition at the customs office where incoming vessels are required to go through the customs procedure as stipulated in Clause 1 of this Article. Correction or addition of information shall be carried out before or after vessels enter;

b) Customs authorities:

b.1) The Customs Sub-department where incoming vessels are required to go through customs procedures shall receive corrected or added information stored into the system and provide such information to competent agencies in order to perform relevant professional tasks;

b.2) As for correction or addition of imported cargo manifest or house bill of lading: the risk management system of the customs department shall be automatically updated with corrected or added information to serve the purpose of applying necessary measures to control risks to shipments while the customs procedure is completed;

b.3) As for correction of other documents: if customs declarants request any amendment or supplementation to declared information after vessels have moved in, and if there is sufficient reasons for this, the director of the customs Subdepartment where vessels are required to go through customs procedures shall decide whether such amendment or supplementation is permitted.

5. In case unexpected events occur due to the failure of electronic customs declaration system, the customs declaration and completion of customs procedure shall be carried out by submitting the paper-based customs documentation as stipulated in Article 15 hereof. When such system is restored to the normal condition, customs declarants shall create and send electronic information on the system.

Article 11. Customs procedure

1. Responsibility of the customs sub-department

a) Receive and manage information provided on the information portal of the General Department of Customs; examine, aggregate and analyze declared information and other information (such as information about risk management or information collected from other organizations in the same or different sector) and carry out handling measures:

a.1) If declared information conforms to legal regulations and there is no doubtful information, customs procedure that incoming vessels are required to go through must be completed;

a.2) If declared information only consist of information about the master bill with none of information about the house bill, vessels are still permitted to move inward but customs declarants are required to provide additional information about the house bill (if available). If customs declarants refuse to present information about the house bill of lading though they are keeping it, customs authority can impose professional measures such as refusal to allow customs clearance or grant permission to move imported shipments out from the customs supervision area;

a.3) If there is a sign that goods transportation violates the customs law, customs authority must allow vessels to move inward, keep watch of them and monitor cargos while being unloaded, stored in the customs supervision area; concurrently report to the Director of the Customs Sub-department to decide the form and extent of physical verification of such cargos and perform other professional tasks in accordance with legal regulations;

a.4) In case there is a request for cessation of completion of customs procedures sent by other competent authorities such as Maritime Administration, Court, Police or Border Security Force, the customs sub-department must show their initiative in cooperating with competent authorities in dealing with such situation in accordance with legal regulations, concurrently report to the Customs Department of a city or province and the General Department of Customs to seek any problem-solving instruction.

b) Under the circumstances stipulated at Point a.1, a.2, a.3 Clause 1 of this Article, after completing customs procedures to allow vessels to move in, the customs Subdepartment shall send an electronic notice of completion of customs procedures for incoming vessel" by completing the form No. 10 of the Appendix II enclosed herewith to the customs declarant, Maritime Administration and other regulatory agencies through the national single-window information portal.

2. Responsibility of the customs declarant

a) Comply with decisions granted by customs authorities in accordance with legal regulations on customs procedures applied to incoming vessels;

b) Create electronic information about customs documentation, send the electronic customs documentation under the provisions of Article 10 hereof;

c) Whenever vessels have moved in and moored at the safe place approved by the Maritime Administration and after application for permission to move in has been accepted by regulatory agencies, the customs declarant is required to send the electronic notice of arrival to the customs Subdepartment where vessels are required to go through customs procedures by completing the form No. 11 of the Appendix II enclosed herewith. Time of sending the notice of arrival shall be considered as the time of ship cargos arriving at Vietnam’s port and the basis for implementing relevant administrative policies.

Section 2: ELECTRONIC CUSTOMS PROCEDURE THAT APPLIES TO OUTGOING SEAGOING VESSELS

Article 12. Creation of electronic information to be provided for customs documentation

1. Customs declarants shall be entitled to select one of two forms of creating electronic information as follows:

a) Creating electronic information which conform to format standards approved by the General Department of Customs and then sending them to the information portal of the General Department of Customs; or

b) Directly carrying out the customs declaration at the information portal of the General Department of Customs.

2. Electronic customs documentation of an outgoing seagoing vessel shall include the specific documents stipulated in the Appendix II enclosed herewith:

a) General declaration form No. 1;

b) Exported sea freight manifest form No. 2;

c) Crew list form No. 4;

d) Seagoing vessel crew’s effects declaration form No. 5;

dd) Ship’s stores declaration form No. 6;

e) Passenger list form No. 7 (if available);

3. Receipt and response of information included in electronic customs documentation.

a) Customs declarants send electronic customs documentation within the permitted period as prescribed in Clause 2 Article 66 of the Decree No. 08/2015/NĐ-CP;

b) The customs electronic data processing system receives information provided by carrying out the electronic customs declaration during 24 hours a day and 7 days a week;

c) Response to information:

c.1) In case declared information conform to all regulated criteria and formats, the customs electronic data processing system shall accept such information by automatically sending the form No. 9 of Appendix II enclosed herewith;

c.2) In case declared information do not conform to all regulated criteria and formats, the customs electronic data processing system shall automatically send notification of reasons for refusal and provide guidance for customs declarants to carry out the customs redeclaration by completing the form No. 9 of Appendix II enclosed herewith.

4. Correction and addition of information provided in the electronic customs documentation of an outgoing vessel.

a) Customs declarant: if there is any request that information provided in the electronic customs documentation of an outgoing vessel must be corrected or supplemented, customs declarants shall carry out this correction or addition at the customs office where outgoing vessels are required to go through the customs procedure as stipulated in Clause 1 of this Article. Time of correction and addition:

a.1) As for exported cargo manifest: within a permitted period of 24 hours from the time vessel moves out;

a.2) As for other documents, such correction or addition must be carried out before vessels move out. If customs declarants request any correction or addition of information after vessels have moved out, and if there are sufficient reasons for this, the director of the customs Subdepartment where outgoing vessels are required to go through customs procedures shall decide whether such correction or addition is permitted.

b) The customs authority: The Customs Sub-department where outgoing vessels are required to go through customs procedures shall receive corrected or added information to get them stored into the system and provide them to competent agencies in order to perform relevant professional tasks.

5. In case unexpected events occur due to the failure of electronic customs declaration system, the customs declaration and completion of customs procedure shall be carried out by submitting the paper-based customs documentation as stipulated in Article 16 hereof. When such system is restored to the normal condition, customs declarants shall create and send electronic information to the system.

Article 13. Customs procedure

1. Responsibility of the customs sub-department

a) Receive and manage customs declaration information provided on the information portal of the General Department of Customs; examine, aggregate and analyze declared information and other information (such as information about risk management or information collected from other organizations in the same or different sector) and carry out handling measures:

a.1) If customs declaration information are conformable to legal regulations, or do not consist of any doubtful sign, the customs procedure must be completed to allow vessels to move out;

a.2) In case there is a request for cessation of completion of customs procedures sent by other competent authorities such as Maritime Administration, Court, Police or Border Security Force, the customs sub-department must show their initiative in cooperating with competent authorities in dealing with such situation in accordance with legal regulations, concurrently report to the Customs Department of a city or province and the General Department of Customs to seek any problem-solving instruction.

b) Under the circumstances stipulated at Point a.1, a.2 Clause 1 of this Article, after completing customs procedures to allow vessels to move in, the customs Subdepartment shall send an electronic notice of completion of customs procedures" by completing the form No. 10 of the Appendix II enclosed herewith to the customs declarant, Maritime Administration and other regulatory agencies through the national single-window information portal.

2. Responsibility of the customs declarant

a) Comply with decisions granted by customs authorities in accordance with legal regulations on customs procedures applied to outgoing vessels;

b) Create electronic information about customs documentation, send the electronic customs documentation under the provisions of Article 12 hereof;

c) After completing customs procedure at regulatory agencies, the customs declarant is required to send the electronic notice of departure to the customs Subdepartment where vessels are required to go through customs procedures by completing the form No. 12 of the Appendix II enclosed herewith. Time of sending the notice of departure shall be considered as the time of ship cargos departing from Vietnam’s port and the basis for implementing relevant administrative policies.

Section 3: ELECTRONIC CUSTOMS PROCEDURE THAT APPLIES TO TRANSIT SEAGOING VESSELS

Article 14. Customs procedure

1. Responsibility of the customs declarant

a) When vessels move in, the customs declarant is required to create information included in the electronic customs documentation and follow customs procedures to apply for permission to move their vessels inward as stipulated in Article 10, 11 hereof;

b) When vessels move out and if there is any change to documents while vessels move in, the customs declarant is required to create electronic customs declaration information which has been changed compared with the information provided at the time of vessel’s moving inward and follow customs procedures to apply for permission to move their vessels outward as stipulated in Article 12, 13 hereof.

2. Responsibility of the customs sub-department where vessels are allowed to move in.

a) Follow the electronic customs documentation to apply for permission to move vessel inward under the provisions of Article 11 hereof;

b) Create a note of transferring customs documentation of a transit vessel by completing the form No. 01/PQC of the Appendix III enclosed herewith, make their confirmation by appending the digital signature and send it to the System;

c) Carry out the customs sealing of cargo storage and bilge (if applicable and necessary);

d) Check the result of customs procedure completion for outgoing vessels on the system given by the customs Subdepartment where outgoing vessels are required to go through customs procedures, collaborate with this Subdepartment in verifying and handling any violation against customs laws (if any).

3. Responsibility of the customs sub-department where vessels move out.

a) Use information provided on the System about the manifest of transit cargos and information about cargos and vessels;

b) Check the state of the customs seal of cargo storage and bilge (if applicable);

c) Provide digital confirmatory signature, send a notice of receipt of information about vessels, cargos and violations relating to vessels, cargos, crew members, passengers to the System, collaborate with the customs Subdepartment where vessels are required to go through customs procedure in legally verifying and dealing with violations of transit vessels against customs laws (if any);

d) Follow the customs procedure applied to outgoing vessels under the provisions of Article 13 hereof.

Section 4: PAPER-BASED CUSTOMS PROCEDURE THAT APPLIES TO INCOMING, OUTGOING OR TRANSIT SEAGOING VESSELS

Article 15. Customs procedure applied to incoming vessels

1. Customs documentation: The customs documentation submitted to move vessels inward shall include documents (if available) stipulated in Clause 2, Article 10 hereof (01 original per each), and 01 copy of the passenger list.

2. Time limit for dealing with customs procedures.

a) As for customs declarants, customs declarants must carry out customs declaration and submit customs documentation not later than 02 hours after the Maritime Administration sends the notice of incoming vessel's arriving at the pilot embarkation position;

b) As for the customs authority, not later than 01 hour from the time customs declarant submits all required customs documentation, they must deal with the customs procedure.

3. Completion of customs procedure:

a) Customs officer shall receive customs documentation, check the sufficiency and appropriacy of documents included in the customs documentation;

b) If these documents are found sufficient and appropriate, customs procedure must be completed. Customs officers sign their name, affix their stamp on documents included in the custom documentation. Especially for the cargo manifest (if available), customs officers are required to write the number of pages, sign their name and affix their stamps on the first and last page of the cargo manifest;

c) In case insufficient or inappropriate documents are provided, customs officers are required to notify customs declarants of this and request them to provide additional necessary information to complete the customs procedure for applying for permission to move vessels inward;

d) After completing customs documentation, customs officers shall send a copy of imported cargo manifest (if available) to the customs Subdepartment where vessels are currently moored, and the customs control team; write information in the customs record or input data into computers about vessel name, flag state, name of ship’s agent (if available), name of ship master, total number of crew members, ship mooring position, cargo title and quantity of ship cargos (if any); file documents in accordance with regulations.

4. Several regulations

a) If declared information only consist of information about the master bill with none of information about the house bill, vessels are still permitted to move inward but customs declarants are required to provide additional information about the house bill (if available). If customs declarants refuse to present information about the house bill of lading though they are keeping it, customs authority can impose professional measures such as refusal to allow customs clearance or grant permission to move imported shipments out from the customs supervision area;

b) If there is a sign that goods transportation violates the customs law, customs authority is obliged to clear vessels to move inward, keep watch of them and monitor cargos while being unloaded, stored in the customs supervision area; concurrently report to the Director of the Customs Sub-department to decide the form and extent of physical verification of such cargos and perform other professional tasks in accordance with legal regulations;

c) In case there is a request for cessation of customs procedures sent by other competent authorities such as the Maritime Administration, Court, Police or Border Security Force, the customs sub-department must show their initiative in cooperating with competent authorities in dealing with such situation in accordance with legal regulations, concurrently report to the Customs Department of a city or province and the General Department of Customs to seek any problem-solving instruction.

Article 16. Customs procedure applied to outgoing vessels

1. Customs documentation: The customs documentation submitted to move vessels outward shall include documents (if available) stipulated in Clause 2, Article 12 hereof (01 original per each), and 01 copy of the passenger list.

2. Time limit for dealing with customs procedures.

a) As for customs declarants, they must carry out customs declaration and submit customs documentation not later than 01 hours before departure. Especially for passenger ships and liners, customs declarants are required to deal with the customs procedure not later than the time these ships or liners are going to leave;

b) As for the customs authority, not later than 01 hour from the time customs declarant submits all required customs documentation, they must deal with the customs procedure.

3. Completion of customs procedure:

a) Customs officer shall receive customs documentation, check the sufficiency and appropriacy of documents included in the customs documentation;

b) If these documents are found sufficient and appropriate, customs procedure must be completed. Customs officers sign their name, affix their stamp on documents included in the custom documentation. Especially for the cargo manifest (if available), customs officers are required to write the number of pages, sign their name and affix their stamps on the first and last page of the cargo manifest;

c) In case insufficient or inappropriate documents are provided, customs officers are required to notify customs declarants of this and request them to provide additional necessary information to complete the customs procedure for applying for permission to move vessels outward;

d) After completing customs procedure, customs officers shall send a copy of exported cargo manifest (if available) to the customs Subdepartment where vessels are currently moored, and the customs control team; write information in the customs record or input data into customs computers about vessel name, flag state, name of ship’s agent (if available), name of ship master, total number of crew members, ship mooring position, time of departure, time of arrival, cargo title and quantity of ship cargos (if any); file documents in accordance with regulations.

4. In case there is a request for cessation of customs procedures sent by other competent authorities such as the Maritime Administration, Court, Police or Border Security Force, the customs sub-department must show their initiative in cooperating with competent authorities in dealing with such situation in accordance with legal regulations, concurrently report to the Customs Department of a city or province and the General Department of Customs to seek any problem-solving instruction.

Article 17. Customs procedure applied to transit vessels

1. Customs procedure on arrival

The customs sub-department where vessels move in shall be responsible for:

a) Implementing regulations laid down in Article 15 hereof;

b) Creating 02 notes of transfer of customs documentation of transit vessels by completing the form No. 01/PQC of the Appendix III enclosed herewith; sealing customs documentation including the following documents (duplicate with adjoining stamp) such as 01 cargo manifest (if available), 01 general declaration, 01 crew list, 01 passenger list (if available), 01 stores declaration, 01 crew's effects declaration, 01 note of transfer of customs documentation of transit vessel. Handing sealed customs documentation to the master in order to forward it to the customs Subdepartment where vessels move out;

c) Carrying out the customs sealing of cargo storage and bilge (if applicable and necessary).

2. Customs procedure on departure.

The customs sub-department where vessels move out shall be responsible for:

a) Requesting the master to submit a sealed customs documentation forwarded by the customs Subdepartment where vessels move in to the customs Subdepartment where vessels move out;

b) Receiving the sealed customs documentation mentioned above from the master;

c) Customs officers of the customs Subdepartment where vessels move out shall sign their names, affix their stamps on the note of transfer of customs documentation of transit vessels and fax it to the customs Subdepartment where vessels move in to notify them of receipt of the customs documentation, cargos and any violation relating to such vessels, cargos, crew members and passengers (if any);

d) Follow the customs procedure applied to outgoing vessels under the provisions of Article 16 hereof.

Chapter II

CUSTOMS PROCEDURE THAT APPLIES TO INCOMING, OUTGOING OR TRANSIT AIRCRAFT

Section 1: ELECTRONIC CUSTOMS PROCEDURE THAT APPLIES TO INCOMING AIRCRAFT

Article 18. Creation of electronic information about customs documentation

1. Customs declarants shall be entitled to select either of two forms of creating electronic information as follows:

a) Creating electronic information which conform to format standards approved by the General Department of Customs and then sending them to the information portal of the General Department of Customs; or

b) Directly carrying out the customs declaration at the information portal of the General Department of Customs.

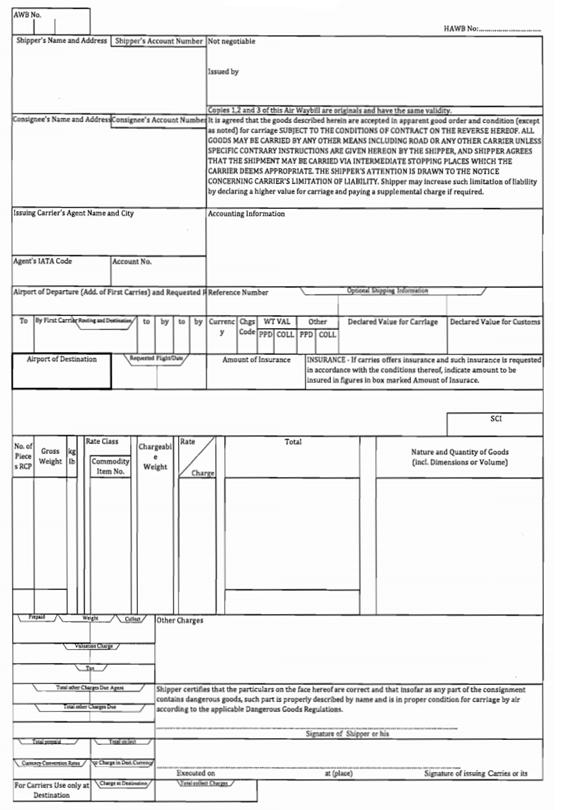

2. Electronic customs documentation of an incoming aircraft shall include the specific documents stipulated in the Appendix IV enclosed herewith:

a) Imported air freight manifest form No. 1 (if available);

b) House bill of lading form No. 2 (if available);

c) Passenger list form No. 3 (if available);

d) Aircrew list form No. 4;

dd) Passenger’s checked luggage manifest form No. 5 (if available).

3. Receipt and response of information included in the electronic customs documentation:

a) Customs declarants send electronic customs documentation within the permitted period as prescribed in Clause 1 Article 62 of the Decree No. 08/2015/NĐ-CP;

b) The customs electronic data processing system receives information provided by carrying out the electronic customs declaration during 24 hours a day and 7 days a week;

c) Response to information:

c.1) In case declared information conform to all regulated criteria and formats, the customs electronic data processing system shall accept such information by automatically sending the form No. 9 of Appendix II enclosed herewith;

c.2) In case declared information do not conform to all regulated criteria and formats, the customs electronic data processing system shall automatically send notification of reasons for refusal and provide guidance for customs declarants to carry out the customs redeclaration by completing the form No. 9 of Appendix II enclosed herewith.

4. Correction and addition of information provided in the electronic customs documentation of incoming aircraft:

a) Customs declarant: if there is any request that information provided in the electronic customs documentation of incoming aircraft must be corrected or supplemented, customs declarants shall carry out this correction or addition at the customs office where incoming aircraft is required to go through the customs procedure as stipulated in Clause 1 of this Article. Correction or addition of information shall be carried out before or after aircraft enters.

b) Customs authorities:

b.1) The Customs Sub-department where incoming aircraft is required to go through customs procedures shall receive corrected or added information stored into the system and provide such information for competent agencies in order to perform relevant professional tasks;

b.2) As for correction or addition of imported cargo manifest or house bill of lading: the risk management system of the customs department shall be automatically updated with corrected or added information to serve the purpose of applying necessary measures to control risks to shipments while the customs procedure is completed.

b.3) As for correction of other documents: if customs declarants request any amendment or supplementation to declared information after aircraft has moved in, and if there are sufficient reasons for this, the director of the customs Subdepartment where aircraft is required to go through customs procedures shall decide whether such amendment or supplementation is permitted.

5. In case unexpected events occur due to the failure of electronic customs declaration system, the customs declaration and completion of customs procedure shall be carried out by submitting the paper-based customs documentation as stipulated in Article 23 hereof. When such system is restored to the normal condition, customs declarants shall create and send electronic information to the system.

Article 19. Customs procedure

1. Responsibility of the customs sub-department

a) Receive and manage customs declaration information provided on the information portal of the General Department of Customs or the paper customs documentation; examine, aggregate and analyze declared information and other information (such as information about risk management or information collected from other organizations in the same or different sector) and carry out handling measures:

a.1) If declared information conforms to legal regulations and there is no doubtful information, customs procedure that incoming aircraft is required to go through must be completed;

a.2) If declared information only consists of information about the master bill with none of information about the house bill of lading, aircraft is still permitted to move inward but customs declarants are required to provide additional information about the house bill of lading. If customs declarants refuse to present information about the house bill of lading, customs authority can impose professional measures such as refusal to allow customs clearance or grant permission to move imported shipments out from the customs supervision area;

a.3) If there is a sign that goods transportation violates the customs law, customs authority must allow aircraft to move inward, keep watch of them and monitor cargos while being unloaded, stored in the customs supervision area; concurrently report to the Director of the Customs Sub-department to decide the form and extent of physical verification of such cargos and perform other professional tasks in accordance with legal regulations;

a.4) In case there is a request for cessation of customs procedures sent by other competent authorities such as the Maritime Administration, Court, Police or Border Security Force, the customs sub-department must show their initiative in cooperating with competent authorities in dealing with such situation in accordance with legal regulations, concurrently report to the Customs Department of a city or province and the General Department of Customs to seek any problem-solving instruction.

b) After completing the electronic customs procedures that allow aircraft to move inward as stipulated at Point a.1, a.2 and a.3 Clause 1 of this Article, the Customs Subdepartment shall send a(n) electronic or paper-based notice (when electronic one is not acceptable) of completing customs procedure" that allows to clear incoming aircraft by filling in the form No. 10 of the Appendix II hereof to customs declarants, Airport Authority and relevant regulatory agencies and airport corporates.

2. Responsibility of the customs declarant

a) Comply with decisions granted by customs authorities in accordance with legal regulations on customs procedures applied to incoming aircraft;

b) Create electronic information about customs documentation, send the electronic customs documentation under the provisions of Article 18 hereof;

c) Whenever aircraft have arrived at the safe parking position appointed by the Airport Authority and after customs procedure is completed to apply for permission to move in with the consent from other regulatory agencies, the customs declarant is required to send the electronic notice of arrival at the airport to the customs Subdepartment where aircraft is required to go through customs procedures by completing the form No. 11 of the Appendix II enclosed herewith. Time of sending the notice of arrival at the airport shall be considered as the time of air cargos arriving at Vietnam’s bordergate and the basis for implementing relevant administrative policies.

Section 2: ELECTRONIC CUSTOMS PROCEDURE THAT APPLIES TO OUTGOING AIRCRAFT

Article 20. Creation of electronic information about customs documentation

1. Customs declarants shall be entitled to select either of two forms of creating electronic information as follows:

a) Creating electronic information which conform to format standards approved by the General Department of Customs and then sending them to the information portal of the General Department of Customs; or

b) Directly carrying out the customs declaration at the information portal of the General Department of Customs.

2. Electronic customs documentation of an outgoing aircraft shall include the specific documents stipulated in the Appendix IV enclosed herewith:

a) Exported air freight manifest form No. 6 (if applicable);

b) Passenger list form No. 3 (if available);

c) Aircrew list form No. 4;

d) Passenger’s checked luggage manifest form No. 5 (if available).

3. Receipt and response of information included in electronic customs documentation:

a) Customs declarants send electronic customs documentation within the permitted period as prescribed in Clause 2 Article 62 of the Decree No. 08/2015/NĐ-CP;

b) The customs electronic data processing system receives information provided by carrying out the electronic customs declaration during 24 hours a day and 7 days a week;

c) Response to information:

c.1) In case declared information conform to all regulated criteria and formats, the customs electronic data processing system shall accept such information by automatically sending the form No. 9 of Appendix II enclosed herewith;

c.2) In case declared information do not conform to all regulated criteria and formats, the customs electronic data processing system shall automatically send notification of reasons for refusal and provide guidance for customs declarants to carry out the customs redeclaration by completing the form No. 9 of Appendix II enclosed herewith.

4. Correction and addition of information provided in the electronic customs documentation of outgoing aircraft.

a) Customs declarant: if there is any request that information provided in the electronic customs documentation of outgoing aircraft must be corrected or supplemented, customs declarants shall carry out this correction or addition at the customs office where aircraft is required to go through the customs procedure as stipulated in Clause 1 of this Article. Time of correction and addition:

a.1) As for exported cargo manifest: within a permitted period of 24 hours from the time aircraft leaves;

a.2) As for other documents, such correction or addition must be carried out before aircraft leaves.

b) The customs authority: The Customs Sub-department where outgoing aircraft is required to go through customs procedures shall receive corrected or supplemented information to get them stored into the system and provide them to competent agencies in order for them to perform relevant professional tasks.

5. In case unexpected events occur due to the failure of electronic customs declaration system, the customs declaration and completion of customs procedure shall be carried out by submitting the paper-based customs documentation as stipulated in Article 24 hereof. When this system is restored to the normal condition, customs declarants shall create and send electronic information to the system.

Article 21. Customs procedure

1. Responsibility of the customs sub-department:

a) Receive and manage customs declaration information provided on customs electronic data processing system or the paper customs documentation; examine, aggregate and analyze declared information and other information (such as information about risk management or information collected from other organizations in the same or different sector) and carry out handling measures:

a.1) If declared information conforms to legal regulations and there is no doubtful information, customs procedure that outgoing aircraft is required to go through must be completed;

a.2) In case there is a request for cessation of customs procedures sent by other competent authorities such as the Airport Authority, Court, Police or other regulatory agencies, the customs sub-department must temporarily suspend the customs procedure and show their initiative in cooperating with competent authorities in dealing with such situation in accordance with legal regulations, concurrently report to the Customs Department of a city or province and the General Department of Customs to seek any problem-solving instruction.

b) After completing the electronic customs procedures that allow aircraft to leave as stipulated at Point a.1 and a.2 Clause 1 of this Article, the Customs Subdepartment shall send a(n) electronic or paper-based notice (when electronic one is not acceptable) of having completing customs procedure" by filling in the form No. 10 of the Appendix II hereof to customs declarants, Airport Authority and relevant regulatory agencies and airport corporates.

2. Responsibility of the customs declarant

a) Comply with decisions granted by customs authorities in accordance with legal regulations on customs procedures applied to outgoing aircraft;

b) Create electronic information about customs documentation, send the electronic customs documentation under the provisions of Article 20 hereof;

c) After completing customs procedures at regulatory agencies, the customs declarant is required to send the electronic notice of departure to the customs Subdepartment where aircraft is required to go through customs procedures by completing the form No. 12 of the Appendix II enclosed herewith. Time of sending the notice of departure shall be considered as the time of air cargos departing from Vietnam’s port and the basis for implementing relevant administrative policies.

Section 3: ELECTRONIC CUSTOMS PROCEDURE THAT APPLIES TO TRANSIT AIRCRAFT

Article 22. Customs procedure

1. Transit aircraft whilst taking a technical stopover shall not be required to carry out the customs declaration. The customs authority shall assume responsibility:

a. Carry out required customs control during the time aircraft stops and parks at the airport.

b. Carry out customs clearance for exported goods used as supplies provided for the aircraft (when applicable).

2. In case transit aircraft whilst taking a stopover at the airport has freight handling or passenger embarkation or disembarkation activities respectively for the import or export, inbound or outbound traveling purposes, the airport corporate shall be accountable to the customs Subdepartment for any relevant information under the provision of Article 64 of the Decree No. 08/2015/NĐ-CP The customs procedure shall include:

a) While aircraft enters, regulations laid down in Article 23 hereof shall be implemented;

b. When aircraft leaves and if there is any change to documents on arrival, the customs declarant and customs authority are required to follow customs procedures stipulated in Article 24 hereof.

c. Carry out customs clearance for exported goods used as supplies provided for the aircraft (when applicable).

Section 4: PAPER-BASED CUSTOMS PROCEDURE THAT APPLIES TO INCOMING, OUTGOING OR TRANSIT AIRCRAFT

Article 23. Customs procedure applied to incoming aircraft

1. Customs documentation: The customs documentation of incoming aircraft shall include documents (if available) stipulated in Clause 2, Article 10 hereof (01 original per each). Especially for imported cargo manifest (if available), the customs declarant is required to submit 02 original copies.

2. Time limit for dealing with customs procedures.

a) As for customs declarants, customs declarants must carry out customs declaration and submit customs documentation immediately after arriving aircraft has managed to park at the position appointed by the Director of Airport Authority;

b) As for the customs authority, not later than 01 hour from the time customs declarant submits all required customs documentation, they must deal with the customs procedure.

3. Completion of customs procedure:

a) Customs officer shall receive customs documentation, check the sufficiency and appropriacy of documents included in the customs documentation;

b) If these documents are found sufficient and appropriate, customs procedure must be completed. Customs officers sign their name, affix their stamp on documents included in the custom documentation. Especially for the imported cargo manifest (if available), customs officers are required to write the number of pages, sign their name and affix their stamps on the first and last page of this manifest;

c) In case insufficient or inappropriate documents are provided, customs officers are required to notify customs declarants of this and request them to provide additional necessary information to complete the customs procedure for applying for customs clearance for incoming aircraft;

d) After completing customs procedures, customs officers shall send a copy of imported cargo manifest (if available) to competent agencies upon request; write declared information in the customs record or input data into computers about aircraft name, nationality, name of aircraft pilot, total number of crew members, aircraft parking position, airport of departure, stop-over or parking time; file documents in accordance with regulations.

Article 24. Customs procedure applied to outgoing aircraft

1. Customs documentation: The customs documentation of outgoing aircraft shall include documents (if available) stipulated in Clause 2, Article 20 hereof (01 original per each). Especially for exported cargo manifest (if available), the customs declarant is required to submit 02 original copies.

2. Time limit for dealing with customs procedures.

a) As for customs declarants, customs declarants must carry out customs declaration and submit required customs documentation immediately before the transport organization terminates their receipt of exported cargos and outbound passengers;

b) As for the customs authority, not later than 01 hour from the time customs declarant submits all required customs documentation, they must deal with the customs procedure.

3. Completion of customs procedure:

a) Customs officer shall receive customs documentation, check the sufficiency and appropriacy of documents included in the customs documentation;

b) If these documents are found sufficient and appropriate, customs procedure must be completed. Customs officers sign their name, affix their stamp on documents included in the custom documentation. Especially for the cargo manifest (if available), customs officers are required to write the number of pages, sign their name and affix their stamps on the first and last page of this cargo manifest;

c) In case insufficient or inappropriate documents are provided, customs officers are required to notify customs declarants of this and request them to provide additional necessary information to complete the customs procedure for applying for customs clearance for outgoing aircraft;

d) After completing customs procedures, customs officers shall send a copy of exported cargo manifest (if available) to competent agencies upon request; write declared information in the customs record or input data into computers about aircraft name, nationality, name of aircraft pilot, total number of crew members, aircraft parking position, airport of arrival, stop-over or parking time; file documents in accordance with regulations.

Article 25. Customs procedure applied to transit aircraft

The customs procedure applied to transit aircraft shall conform to the provisions of Article 22 hereof.

Chapter III

CUSTOMS PROCEDURE APPLIED TO ROAD OR INLAND WATER TRANSPORT THAT CROSSES BORDERGATES

Section 1: GENERAL PROVISIONS

Article 26. Receipt and inspection of customs documentation of transport

1. Temporarily imported overseas transport or temporarily exported Vietnamese transport:

a) Customs declarants shall be responsible for submitting and presenting documents stipulated in Article 74, 75, 78, 79 and 80 of the Decree No. 08/2015/NĐ-CP Declaration of temporary imported – re-exported, temporary exported – re-imported road transport by completing the form No. 1 of the Appendix V enclosed herewith. Declaration of temporary imported – re-exported, temporary exported – re-imported water transport by completing the form No. 2 of the Appendix V enclosed herewith.

b) Responsibility of the customs authority:

b.1) Receive customs documentation submitted and presented by the transport operator;

b.2) Inspect such documentation, count the number and type of documents and check document contents with particular attention paid to the following documents:

b.2.1) Permits granted by competent agencies (except for transport operating at the bordergate area and means of inland water transport of which permits are not required under the International Agreement between Vietnam and bordering countries): Check whether the term of temporary import – re-export is still valid, transport route, port of exit and port of entry;

b.2.2) Valid vehicle registration certificate;

b.2.3) Other documents including:

b.2.3.1) Driver’s license categorized by vehicle types;

b.2.3.2) Valid certificate of motorized transport inspection in conformity with the International Agreement on road transportation between Vietnam and bordering countries, which must be suitable for specific journeys;

b.2.3.3) Passport of drivers and vehicle registration certificate issued in the same country

- Except for vehicles of diplomatic missions, including Embassy, Consulate General, Trade Office and News Agency with the license plate granted by the other signing party, which run across the border to perform public tasks.

- Unless otherwise specified in the International Agreement between Vietnam and bordering countries.

In the process of checking documentation of means of transport, if there is any insufficient or invalid document, the customs Subdepartment shall refuse to accept such documentation, clarify the reasons for such refusal and point out which document is additionally needed and then return it to the customs declarant. If there is any other request, customs declarants must submit the written request by filling in the form No. 3 of the Appendix V enclosed herewith.

2. Re-exported overseas transport or re-imported Vietnamese transport:

a) Responsibility of the customs declarant:

a.1) Customs declarants shall be responsible for submitting and presenting documents stipulated in Article 74, 75, 78, 79 and 80 of the Decree No. 08/2015/NĐ-CP Declaration of temporary imported – re-exported, temporary exported – re-imported road transport by completing the form No. 1 of the Appendix V enclosed herewith. Declaration of temporary imported – re-exported, temporary exported – re-imported water transport by completing the form No. 2 of the Appendix V enclosed herewith.

a.2) Make supplementary customs declaration (if any) if there is any change to the initial customs declaration in the process of temporary import or export.

b) Responsibility of the customs authority:

b.1) Receive customs documentation submitted or presented by customs declarants, and input data into box or item given on the road transport administration software;

b.2) Inspect such documentation, count the number and type of documents and check document contents with particular attention paid to the following documents:

b.2.1) Document indicating the extension of operational time of means of transport (if any);

b.2.2) Permits granted by competent authorities (specifying the valid term of temporary import - reexport, transport route, etc.);

b.2.3) Other documents including:

b.2.3.1) Valid driver’s license categorized by vehicle types;

b.2.3.2) Valid certificate of motorized transport inspection in conformity with the International Agreement on road transportation between Vietnam and bordering countries;

b.2.3.3) Passport of drivers and vehicle registration certificate issued in the same country:

- Except for vehicles of diplomatic missions, including Embassy, Consulate General, Trade Office and News Agency with the license plate granted by the other signing party, which run across the border to perform public tasks.

- Unless otherwise specified in the International Agreement between Vietnam and bordering countries.

In the process of checking documentation of means of transport, if there is any insufficient or invalid document, the customs Subdepartment shall refuse to accept such documentation, clarify the reasons for such refusal and point out which document is additionally needed and then return it to the customs declarant. If there is any other request, customs declarants must submit the written request by filling in the form No. 3 of the Appendix V enclosed herewith.

Article 27. Customs declaration for outgoing, incoming means of transport.

1. Customs declaration for outgoing or incoming cars, motorcycles or motorbikes.

a) Using the road transport administration software:

a.1) Responsibility of the customs officer:

a.1.1) Receive and inspect customs documentation submitted or presented by customs declarants in accordance with regulations laid down in Article 26 hereof. If these means of transport meet requirements for entry or exit, the customs officer shall input data into box or item given on the road transport administration software;

a.1.2) Print out the transport declaration from the road transport administration software.

a.2) Responsibility of the customs declarant: sign their name into the transport declaration, bear responsibility for the accuracy of information that has been provided for customs authorities.

b) Failing to use the road transport administration software due to software, network errors or electricity failure:

b.1) Responsibility of the customs officer:

b.1.1) Offer transport declaration form for free to customs declarants.

b.1.2) Assist or instruct customs declarants in filling information in boxes or items given on the transport declaration (including 2 copies) at the section to be filled by transport operators.

b.2) Responsibility of the customs declarant: carry out the customs declaration and sign their name into the transport declaration, bear responsibility for the accuracy of information that has been provided for customs authorities.

2. Customs declaration for outgoing or incoming inland watercraft (which is registered under the legislation of Vietnam and Cambodia).

a) Customs declaration of outgoing or incoming inland watercraft shall also conform to regulations on outgoing or incoming cars, motorcycles or motorbikes laid down in Clause 1 of this Article. Especially, declaration of temporary imported – re-exported, temporary exported – re-imported water transport shall be completed by filling in the form No. 2 of the Appendix V enclosed herewith.

b) The customs procedure applied to seagoing vessels of Vietnam, Cambodia and the third country with the call sign (IMO) which enter or exit through Vinh Xuong bordergate, An Giang province, and Thuong Phuoc bordergate, Dong Thap province, shall conform to regulations laid down in Chapter I, Part II hereof.

Article 28. Decision on the form and extent of customs inspection of means of transport, customs investigation into means of transport

1. Decision on the form and extent of inspection of means of transport.

a) If means of transport has been found with no sign or suspect of violation at the time the customs procedure is dealt with, customs officers can put a mark (or a tick on the road transport administration software) into the box given in the customs declaration in order to allow such means of transport to be exempted from customs inspection;

b) If means of transport violates the permitted operational period, goes through the temporary import, export procedure for the first time, or it is suspected that there is a difference between submitted documentation and current state of such means of transport, or it is established that such means of transport is carrying illegal cargos or has a sign of violation against laws, customs officers put a mark (or a tick on the system) into the box indicating the inspection of means of transport given in the customs declaration.

2. Customs inspection of means of transport

a) Customs inspection of means of transport refers to the comparison of customs documentation submitted or presented by customs declarants with the current state of means of transport which is conducted by customs officers. Customs inspection contents shall include:

a.1) As for road transport, checking the license plate. If there is any suspicion, frame number, engine number must be checked. Checking cargo storage space (if any);

a.2) As for water transport, checking the license plate, registration certificate, certificate of conformity to technical safety standards; checking cargo storage space (if any);

b) If there is sufficient proof that means of transport is concealing illegal cargos or has a sign of violation against laws, customs officers must report to the Director of the Customs Subdepartment to obtain his/her decision to conduct a search of such means of transport. The searching contents shall include a thorough search or investigation into positions likely to conceal smuggling, banned or undeclared commodities. Procedure or process for investigation into means of transport shall conform to regulations laid down in the law on penalties for administrative violations and other directional documents;

c) In the process of inspection and search of means of transport, customs officers use supportive equipment for this inspection and search.

3. Dealing with the result of inspection and search of means of transport.

a) If there is no violation detected, customs officers must complete required customs procedure for means of transport;

b) If any violation has been detected, customs officers shall issue the traffic ticket and impound means of transport to impose any penalty in accordance with laws.

Article 29. Completion of customs procedures for means of transport

1. As for overseas means of transport:

a) Temporary import:

a.1) As for means of transport that enter under the consent from Vietnam's competent authorities:

Customs officers write the result of inspecting means of transport (if any), sign their name and affix their stamp onto the transport declaration, send the transport operator the copy No.1 of the temporary import - reexport transport declaration to use it as the on-the-road document and submit it to the Custom Subdepartment of re-export when this means of transport is reexported, and store the copy No.2 of the transport declaration at the customs Subdepartment of re-import for the purpose of monitoring and inspection.

a.2) As for means of transport that enters under the intermodal transport permit (according to the International Agreement of which Vietnam is a signatory):

In addition to work contents mentioned at a.1 Clause 1 of this Article, customs officers who are tasked with customs inspection and control of means of transport shall sign their name, affix their stamp, or "Vietnam customs" stamp, like the sample issued by the Director of the General Department of Customs, onto the intermodal transport permit.

b) Reexported means of transport

b.1) As for means of transport which is temporarily imported under the consent or equivalent document issued by Vietnam’s competent authorities, customs officers shall write the result of customs inspection (if any), sign their name, affix their stamp onto the copy No.1 of the temporary import – re-export transport declaration to serve the purpose of final inspection of the temporary import – re-export documentation;

b.2) As for means of transport temporarily imported under the intermodal transport permit, in addition to work contents mentioned at b.1 Clause 1 of this Article, customs officers who are tasked with customs inspection and control of means of transport shall affix "Vietnam customs" stamp, like the sample issued by the Director of the General Department of Customs, onto the intermodal transport permit.

2) As for Vietnamese means of transport:

a) Temporary export means of transport:

a.1) As for means of transport which exits under the written consent from Vietnam’s competent authorities, customs officers shall write the result of customs inspection, sign their name, affix their stamp onto the temporary export – re-import transport declaration; send the transport operator the copy No.1 of the temporary export – re-import transport declaration to resubmit it to the customs Subdepartment of re-import bordergate when this means of transport is re-imported, and store the copy No.2 of the transport declaration at the customs Subdepartment of temporary export bordergate to serve the purpose of monitoring and final inspection.

a.2) As for means of transport that exits under the intermodal transport permit (according to the International Agreement of which Vietnam is a signatory):

a.2.1) The intermodal transport permit designed as an intermodal record (applicable in terms of the International Agreement that Vietnam has signed with Laos and Cambodia): customs officers shall affix the “Vietnam Customs” stamp, like the sample issued by the Director of the General Department of Customs, onto this intermodal transport permit.

If the transport declaration is not printed out, after affixing "Vietnam customs" stamp like the sample issued by the Director of the General Department of Customs onto the intermodal transport permit, customs declarants shall write the number of transport declaration sheets on the upper half of the stamp.

a.2.2) The A4-size intermodal transport permit (applicable in terms of the International Agreement that Vietnam has signed with China): customs officers shall affix the “Vietnam Customs” stamp like the sample issued by the Director of the General Department of Customs onto this intermodal transport permit (if the logbook is attached, the attached logbook should be stamped as well).

If the transport declaration is not printed out, after affixing "Vietnam customs" stamp like the sample issued by the Director of the General Department of Customs onto the intermodal transport permit, customs declarants shall write the number of transport declaration sheets on the upper half of the stamp.

b) Reimported means of transport

b.1) As for means of transport which exits under the written consent from Vietnam’s competent authorities, customs officers shall write the result of customs inspection, sign their name, affix their stamp onto the copy No.1 of the temporary export – re-import transport declaration and take back the copy No.1 of the transport declaration to serve the purpose of final inspection of temporary export – re-import documentation;

b.2) As for means of transport that exits under the intermodal transport permit (according to the International Agreement of which Vietnam is a signatory):

b.2.1) The intermodal transport permit designed as an intermodal record (applicable in terms of the International Agreement that Vietnam has signed with Laos and Cambodia): customs officers shall affix the “Vietnam Customs” stamp like the sample issued by the Director of the General Department of Customs onto this intermodal transport permit;

b.2.2) The A4-size intermodal transport permit (applicable in terms of the International Agreement that Vietnam has signed with China): customs officers shall affix the “Vietnam Customs” stamp like the sample issued by the Director of the General Department of Customs onto this intermodal transport permit (if the logbook is attached, the attached logbook should be stamped as well).

Article 30. Regulation on final inspection

1. Final inspection of means of transport through the software-powered system:

The final inspection shall be carried out through the software-powered system in conformity with the instructions to use the software published by the Director of the General Department of Customs.

Customs officers shall sign their name, affix their stamp at the right corner of the first page of the response slip, or original (duplicate or fax) of the transport declaration (copy No.1), official dispatch (if Vietnam’s means of transport has the intermodal transport permit, the printed transport declaration is not required) of the customs Subdepartment of re-export or re-import which has not been connected with the system, and put a stamp titled "finally inspected" like the sample issued by the Director of the General Department of Customs; store documents in accordance with legal regulations.

2) Paper-based final inspection of means of transport:

a) Paper-based final inspection of temporarily imported means of transport:

a.1) Bases for the final inspection:

a.1.1) If the customs Subdepartment of temporary import or re-export is connected with the system:

a.1.1.1) The customs Subdepartment of temporary import, re-export through the same bordergate shall rely on the customs transport declaration (copy No.1) identical with the data checked on the system in order to carry out the final inspection of the temporary import customs documentation;

a.1.1.2) The customs Subdepartment of re-export through the different bordergate shall rely on the customs transport declaration (copy No.1) identical with the data checked on the system in order to carry out the final inspection of the temporary import customs documentation;

a.1.1.3) If the customs Subdepartment where means of transport is required to go through the customs procedure for import (temporary import) has not been connected with the system, the final inspection of the temporary import customs documentation shall be based on the transport declaration (copy No.2) and the response slip, original (or fax) of the transport declaration (copy No.1) from the port of re-export.

a.2. Procedure for the final inspection:

Customs officers shall stamp their work identification number at the right corner of the first page of the transport declaration and put a stamp titled “Finally inspected” like the sample issued by the Director of the General Department of Customs; carry out the document filing in accordance with legal regulations.

b) Final inspection of temporary export transport documentation:

b.1) Bases for the final inspection:

b.1.1) If the customs Subdepartment of temporary export or re-import is connected with the system:

b.1.1.1) The customs Subdepartment of temporary export, re-import through the same bordergate shall rely on the transport declaration (copy No.1) or the intermodal transport record (if the transport declaration is not printed out) identical with the data checked on the system in order to carry out the final inspection of temporary export customs documentation;

b.1.1.2) The customs Subdepartment of re-import through the different bordergate shall rely on the transport declaration (copy No.1) or the intermodal transport record (if the transport declaration is not printed out) identical with the data checked on the system in order to carry out the final inspection of temporary export customs documentation;

b.1.2) If the customs Subdepartment where means of transport is required to go through the customs procedure for temporary export has not been connected with the system, the final inspection of the temporary export customs documentation shall be based on the transport declaration (copy No.2) and the response slip, original (or fax) of the transport declaration (copy No.1) delivered by the customs Subdepartment of temporary import.